Furthermore, we confirm that a basket containing main currencies (euro, U.S. dollar by euro would improve bilateral trade between Iran and its major trade partners especially the European Economic and Monetary Union (EMU). In addition, gravity model and Generalized Method of Moments estimation confirm that substitution of U.S. Based on OCA index, euro would be a good substitution for U.S. We explore these effects via Optimum Currency Area (OCA) theories using generalized least square from 2000 to 2018. dollar as an anchor currency for Iranian rial and whether this replacement would affect Iran’s international trade positively. The aim of the paper is to find out whether euro is a convenient substitution for U.S. © 2018, Institute of Geography of the Slovak Academy of Science. Another important driver is the market volatility for the short-end basis spread, and the EUR/USD exchange rate for the long-term basis spread, and to a lesser extent, the Fed/ECB balance sheet ratio.

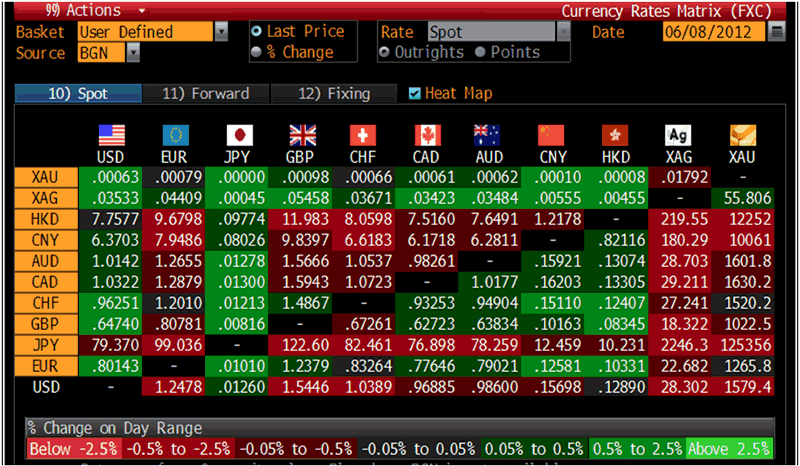

#Bloomberg cross currency rates drivers

The most important drivers of the cross-currency basis spreads appear to be short- and long-term EU financial sector credit risk indicators, and to a slightly lesser extent, short- and long-term US financial sector credit risk indicators. We suggest market proxies for EUR/USD basis swap spread drivers and build a multiple regression and a cointegration model to explain their significance during three different historical periods of basis widening. Credit and liquidity risk, as well as supply and demand have often been cited as general factors driving cross-currency basis spreads, however, these spreads may widen beyond what is normally explained by such variables. This paper investigates the drivers of cross-currency basis spreads, which were historically close to zero but have widened significantly since the start of the financial crisis.

0 kommentar(er)

0 kommentar(er)